How Do Credit Reference Agencies Decide Your Credit Score?

Your credit score is a snapshot of your financial history. It where shows how reliable you are when it comes to money. In the UK, you have a legal right to view your credit score for free at any time.

The credit referencing agency collects and stores the information about your credit history. This information is used to calculate your overall credit score. Your score can affect your chances of being accepted for credit – whether it’s a loan or a phone contract.

Here are 5 things you should know.

1- Risk

CRAs use the data they hold to create your score. The score reflects how risky you might be to a lender. The higher your score, the lower the risk you pose, therefore increasing your likelihood for a loan approval.

2- More options

In the UK, there are three main credit referencing agencies; Experian, Equifax and TransUnion. The agencies will differ from other countries. However, when you apply for credit, a lender could choose to check with one, two, or all three agencies.

3- They know a lot about you

Credit reference agencies know a lot more about you than you realise. Many organisations report data to the CRAs, including utility companies, banks, and credit unions. They will also have access to readily available public information like County Court Judgement (CCJ) and the Electoral Roll.

However, the CRAs are bound by the Data Protection Act and must ensure all the data they hold is safe, accurate and relevant.

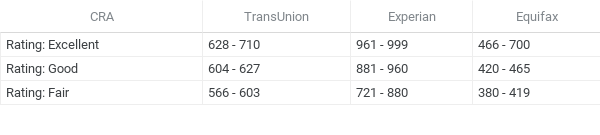

4- Your score differs

Credit ratings are not a universally agreed-upon rating system. Each credit reference agency has its scoring system, so your scores will differ with each one. This means a rating of 600 may be good with one, but terrible with another. Nonetheless, don’t fret, your score will be reflected based on the scoring system.

5- Not all checks leave a footprint

If you or your employer requests a credit report, the CRAs will leave a soft check. A soft check is a brief view of your credit rating without delving deep into your credit history.

However, if you craft credit applications for a mortgage, loan or credit card, a hard checkmark is stamped on your credit report. This means a temporary negative score is left on your report and these can be seen by other lenders and credit reference agencies.

To know the difference between soft and hard checks.

What are the main factors considered in the score?

All of the CRAs base the score on your track record for managing money. Some of the factors they take into account;

- How much money do you owe lenders

- Your history of missed and late payments

- History of going over your credit limit

- Credit card withdrawal

- Credit defaults

- Joint accounts with someone with a bad credit history

- Being on an electoral roll

- Moving house too often

- Living at an address with a creditor who had debt but didn’t update their address

- Making too many credit applications in a short period

- Errors on your credit history

What information do the CRAs hold?

Below are some of the data CRAs1 can hold on you;

- Name, current and previous address (up to six years)

- Whether you’re registered on the electoral roll

- How many accounts have you opened in the last six years (+ open dates)

- Regular payments, missed payments, late payments

- How much credit is available to you, and how much of it do you use

- Who you are financially associated with

- Whether you have had a default, CCJ, IVA, or bankruptcy in the past six years

But how do they work?

A point system determines the credit score and therefore reflected in your credit report. For example, if you have paid your bills on time, you will generate a positive point. However, if you default or have multiple missed payments, you will incur a lot more negative points. You can have negative and positive points in your report which the CRAs will calculate your final score.

The chart above indicates the score ranges for ‘Fair, Good, and Excellent’ for Experian, Equifax and TransUnion. As you can see, each system has a different score rating – so you can rest assured knowing that one score with a CRA does not mean it will be bad in another CRA.

Lendwise does not take responsibility for any financial problems. The content created was to offer support and understanding of credit scores. If you are unsure, make sure you seek independent advice.

- Information Comissioner’s Office. Credit. https://ico.org.uk/for-the-public/credit/#:~:text=Most%20of%20the%20information%20held,and%20bankruptcy%20and%20insolvency%20data. ↩︎