Helpful Facts About ISAs You Need To Know

⚠️ Don’t invest in Stock & Shares or Innovative Finance ISAs unless you’re prepared to lose money. They are a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more. https://lendwise.com/invest/education

The 2023/24 tax year is nearing closer and closer on April 6th. But for many people, the new tax year may be their first eligible ISA year and they won’t necessarily understand what ISAs are and their benefits.

If you’re looking to understand a little more about ISAs, we’ve put together a small guide to help you.

Let’s begin,

#1 What is an ISA?

‘ISA’ stands for Individual Savings Account. An ISA is part of a tax-free** wrapper scheme which allows people to invest their money and earn capital gains without paying taxes.

The Government sets the annual ISA allowance limit each year. ISAs are provided by banks, building societies, insurers, asset managers and National Savings and Investments, which have to be authorised by the Financial Conduct Authority (FCA).

#2 What is an ISA Season?

An ISA season differs from a tax year. Many think the season correlates to a year, similar to sports. However, an ISA season lasts between one to two months. Many providers begin the season from February until the beginning of the new tax year. During the season, savers are encouraged to make the most of their remaining tax-free allowance before the end of the tax year, ending on April 5th.

#3 What is the ISA Annual Allowance Limit?

The Government sets the annual ISA Allowance each year, starting on April 6th and ending on April 5th.

For the remaining 2022/23 tax year, the allowance is £20,000 and an additional £9000 for Junior ISAs.

However, the ISA Allowance limit for the 2023/24 tax year has been again untouched for the sixth consecutive year at £20,000.

#4 How many types of ISAs are there?

You can choose between four different types of ISAs and you can diversify your allowance between them.

The four types of ISAs are:

- Cash ISA: Opened to all UK residents over 16, these include regular savings and fixed-rate Cash ISA.

- Stocks & Shares ISA: An stock market ISA version with no tax on gains and dividends. Opened to age 18 and above, any investments should be carefully considered as investments can rise and fall, and past performance is not guaranteed to succeed. *Your capital is at risk.

- Lifetime ISAs: An ISA designed for first-home buyers and/or savings for later in life. Only available for those between 18-39, but you can pay in before your 50th birthday. They have a contribution of £4000 per year and receive a 25% extra (up to £1000) from the Government.

- Innovative Finance ISA: A peer-to-peer lending account open to UK residents over 18. IFISA investments are classified as a high-risk-high-reward investment with average returns of 9% p.a.* *Your capital is at risk.

In addition, there is a separate Junior ISA you can open for each of your children.

- Junior ISA: Can be opened for each of your children up to the day before their 18th birthday. The child can take access to the account from the age of 16 and they can also remove all funds at 18.

#5 You can move your ISAs to other providers

One benefit of an ISA is you may choose to move any ISA into a brand new ISA with a different provider. In addition, you may also choose to combine an old Cash ISA with a brand new Cash ISA to centralise your investment.

#6 Are your investments protected by the FSCS?

Your investments in a Cash ISA or Stocks & Shares ISA are protected under the Financial Services Compensation Scheme (FSCS). The compensation was set up to protect investors in case providers go out of business, therefore you can claim up to £85,000 per provider (or £170,000 for a joint ISA).

However, an IFISA is not protected by the FSCS if a business goes out of business, so you may lose your investments.

#7 Returns are not taxable

Any gains or dividends you earn through an ISA are not subject to tax. This means that you won’t need to pay any tax when you withdraw your account. However, you will have to pay tax if use a non-ISA investment account.

#8 When did each ISA start

On the first day of the 1999/2000 tax year, ISA replaced the old Personal Equity Plans (PEPs) and the Tax-Exempt Special Savings Accounts (TESSAs). With this, Stocks & Shares ISA and the Cash ISA emerged.

In 2011, the Junior ISA became available for those under 18.

In 2015, the Help to Buy ISA was launched as a pre-Lifetime ISA. However, this ceased to exist in 2019.

In 2016, Innovative Finance ISA became available. With similarities to the Cash ISA and the Stocks & Share ISA, Innovative Finance ISA was designed with a peer-to-peer lending investment in mind.

Lastly, the Lifetime ISA became available for the 2017/18 tax year and fully replaced the Help to Buy ISA.

#9 How much can you invest?

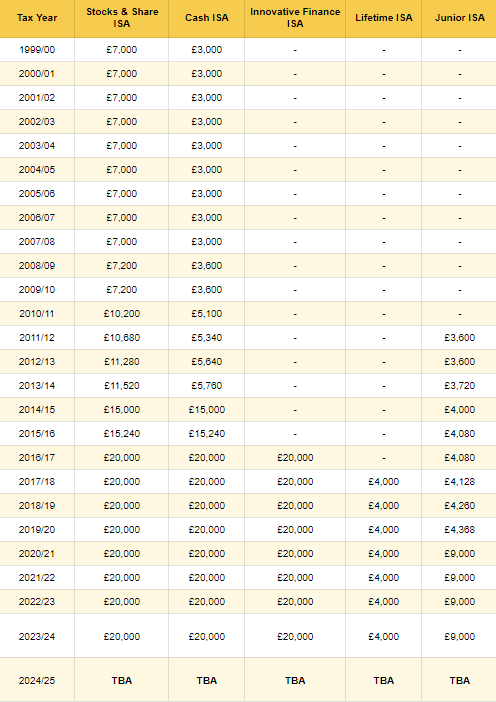

Over time, the ISA allowance limit has increased. However, since 2017/18, the allowance has remained the same. The 2023/24 ISA Allowance limit is still questionable but it’s not yet been announced, their allowance is left blank.

History of the annual ISA allowance:

For more information about ISAs, visit the Government website on ISAs.

To invest in a Lendwise IFISA, visit Invest With Lendwise. For more information about the risks of investing, visit Risk Warning.

**The tax treatment of interest and reliefs on defaults may be subject to change and tax treatment will depend on your individual circumstances.