Whether you’re looking to invest in a Cash ISA or an Innovative Finance ISA, you need to know if it’s still a good idea to invest your hard-earned money.

Why save into an ISA?

Using an ISA (Individual Savings Account) means you can earn interest on your savings without paying tax on any interest or capital gains – a win-win solution. Unfortunately in recent years, low interest rates coupled with high inflation make it near impossible to get a good return.

Why use an ISA?

The benefit of an ISA is the tax-free** wrapper you will earn on any interest, dividends, or capital gains from your investments, no matter how much you earn. The downside to an ISA is you can only invest up to the maximum annual allowance, which for the 2022/23 financial year is £20,000.

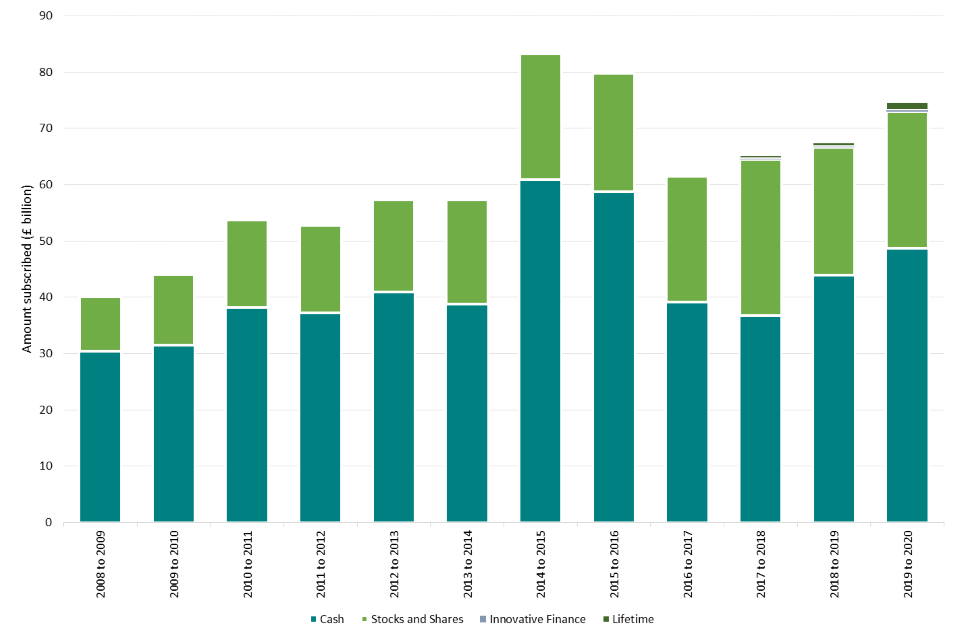

In the 2019/20 tax year, HMRC reported subscriptions of roughly 13 million Adult accounts. During that period, a staggering £75billion was invested.

Do ISAs give the best rate?

Not all ISAs pay the best interest rate. All banks and building societies advertise the ISAs using gross interest rates and this can help you compare accounts on a like-for-like basis. During periods of low interest rates, keeping money in any ISAs could result in a loss. The amount of interest earned is tied to the Bank of England’s base rate.

Are ISAs safe?

Typically, as long as the firm registers with and falls under the regulation of the Financial Conduct Authority (FCA). You can usually find this information at the bottom of the provider’s website. However, you should be aware there are some websites which promote an ISA product while not certified by the FCA. To view whether a bank or building society is safe for you to invest in, you should take a moment to look at the FCA Registry and the Government’s list of approved Savings Account (ISA) Managers.

Check if the firm is registered with the Information Commissioners Office (ICO).

Which ISAs give you the best rate of return?

They all have their benefits and drawbacks, but there are certain differences from each other. This helps to diversify your investment to minimise the risk and maximise the potential rate of return.

Historically, the ISA with the best base rate of return is the Lifetime ISA. However, with the limitation imposed on the LISA, the current best route is either the Stocks & Shares ISA or the Innovative Finance ISA.

| ISA | Pros | Cons |

|---|---|---|

| LISA | – You will earn 25% of any investment from the Government (up to £1000) per year – You can use the ISA to help purchase your first home or use it for retirement after you turn 60 years old – Your money is covered by the Financial Services Compensation Scheme (FSCS) | – You can only invest up to £4000 per tax year – You can only open an account between the ages of 18 to the day before your 40th – You can only use the ISA to purchase your first home or withdraw funds after you turn 60 years old – If you withdraw money for any other reason (with the exception of death or terminal disease), you will lose the 25% interest and may also incur a withdrawal penalty fee |

| Stocks & Shares ISA | – You can invest up to the maximum ISA allowance – Any returns on your investment are tax-free – You may choose where and how to invest your money – Your money may be covered by the FSCS if the platform goes bust | – Interest rates can fluctuate depending on the movement in the market – Your investment is at risk. You can lose all the money you have invested – The market is unreliable – There are numerous sources with market tips which could help you make or lose money |

| IFISA | -You can invest up to the maximum ISA allowance – Any returns on your investment are tax-free – Typically has a higher interest rate than Stocks & Shares ISA and the Cash ISA – IFISA utilises the peer-to-peer lending network and removes the middleman giving you a higher return investment | – Not covered by the FSCS – Your investment is at risk. You can lose all the money you have invested |

Are ISAs worth the investment?

Innovative Finance ISA, also known as IFISA, utilises the peer-to-peer lending network. By investing your allowance in an IFISA, you can cut out the middleman (i.e. the bank) and in return gain a higher percentage of the interest rate.

P2P lending has become very popular in recent years as a way for savers to earn more interest compared to alternative ISA or lending accounts. Various platforms provide investors and lenders with the opportunity to lend money to small businesses or individuals. In return, investors earn interest over time.

Broadly speaking, P2P loans are high-risk investments. However, the higher the risk, the higher the potential returns. Across the board, typical rates range between 4-10% with your investment tied for a long term. Withdrawals are generally possible unless the platform is utilizing your funds, but there might be a waiting period before receiving them back.

Lendwise IFISA

You can earn *tax-free interest on your investments by financing Support postgraduate education on the Lendwise platform. With an IFISA, you can use our AutoLend feature to help you diversify your investments across multiple loans to minimise the risk of loss. Learn more about how a Lendwise IFISA can help your money do good.

Check our Lender terms and conditions.

You can find out more information about a Lendwise IFISA.

- How much money can you invest in an ISA?

- What is the 2023/24 ISA Allowance limit?

- How many types of ISAs can you have at once?

*This figure was correct as of 29 June 2023

**The tax treatment of interest and reliefs on defaults may be subject to change and tax treatment will depend on your individual circumstances.