Smart Risk Diversification: Lendwise AutoLend

Investing has many fundamental principles everyone should follow. One is it’s better to spread your money rather than hold all your eggs in one basket.

Ensure a diversified investment portfolio to avoid over-exposure to a single asset or risk. This approach is also deemed the best for achieving higher, long-term returns. As positive performance in some investments can outweigh the negative performance of others.

No matter what you are investing in, it’s important to consider what your appetite for risk is. This will reflect what type of investment you’ll invest in.

At Lendwise we make it easy for investors to manage their risk diversification on their investments by choosing which borrowers to lend to.

We lend primarily to UK residents studying for a postgraduate degree or professional qualification, but borrowers will come from a range of backgrounds. Meanwhile, each profile will have a corresponding interest rate which you will earn if you decide to lend to them.

Generally speaking, the higher the interest rate the higher the risk. If you choose to invest only at the highest available interest rates, then you increase the risk of loan defaults, bad debts and write-offs. Therefore, it’s sensible to consider a balance of investments with some low-risk and high-risk funds that give you a wide range of interest rates.

Lending across various periods is another good way of diversifying your portfolio. Most peer-to-peer loans range in length from anywhere between one month and ten years.

As part of the borrowers’ profile, you will be able to see how the duration of the loans differs based on how long that person is studying. If you choose a blend of loans with varying time horizons, then you minimise the risks of being too “concentrated” in one type of investment.

As well as increased diversity, it also provides you with greater liquidity from your investments. At any one point, you may have a loan close to maturing which provides you with a steady stream of cash.

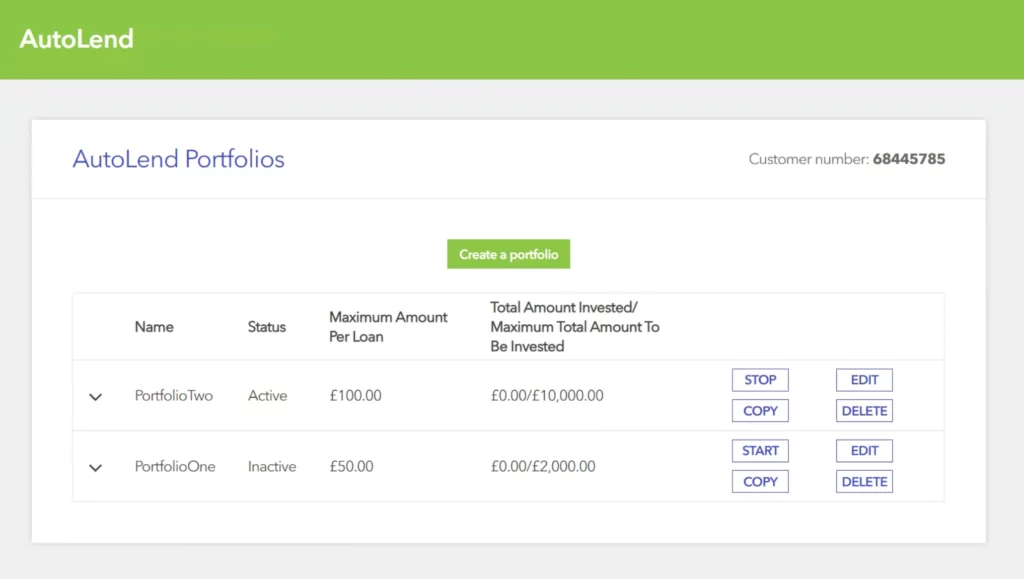

For investors, it can take time and research to select the right mix of investments, which is why we created an ‘auto-lend’ function. This tool helps you to build personalised loan portfolios that reflect your investment objectives and risk appetite.

Complete the process effortlessly with just five simple steps:

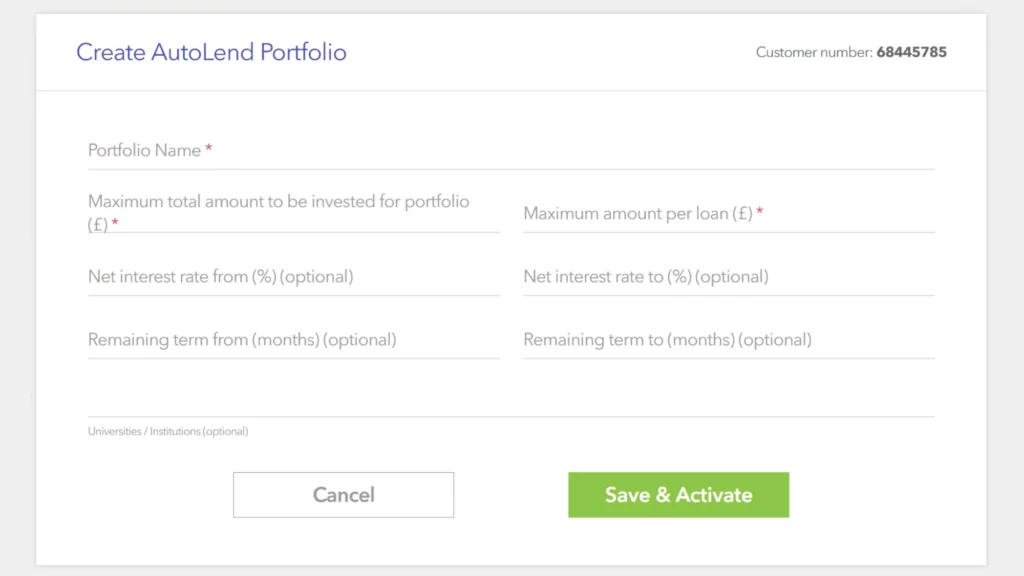

(1) Create a new AutoLend Portfolio

(2) Select the maximum amount of money you wish to invest

(3) Specify the maximum amount to invest in an individual loan

(4) Customize your AutoLend strategy by selecting your interest rate parameters, your preferred remaining term and your chosen universities

(5) Activate your AutoLend strategy and monitor your investment progress to adapt your approach over time

Do you prefer to automate your investments? Or do you prefer to hand-pick each loan? Ultimately, the choice is yours.

However, irrespective of the approach, it’s always important to remember that arguably the greatest rule of investing, is to diversify.