Debunking 17 Common Misleading ISA Myths

Are you looking to invest in ISAs but need more information? Our guide debunks 17 common misleading ISA myths and helps you understand what ISA actually mean.

I.S.A. stands for Individual Savings Accounts. The difference between it and other savings accounts is that ISAs offer tax-free** returns on your investment. You could get more from your money. Every tax year starting on the 5th of April, you will have a maximum allowance you will be able to invest in ISAs. Currently, the 2023/24 ISA allowance is £20,000. You can find out more information on the UK Government website.

Unfortunately, it also means the ISA myths are in full force which hazes many people on the truth of the many benefits ISAs bring. It also means we are less likely to engage with them but luckily the misconceptions are easy to explain.

ISA Myths 1-5

Myth 1

“You can only invest in Cash ISAs”

This is 100% wrong. You have the choice to invest up to £20,000 in any or all four of the current ISA options once per tax year;

– Cash (CISA)

– Stock & Share (SSISA)

– Lifetime (LISA – max £4000 per year)

– Innovative Finance (IFISA)

You are within your own right as a resident of the UK to choose whichever ISA to place your money into. Beware, the Lifetime ISA is not an investment pool and the Innovative Finance ISA is not protected by the FSCS.

Myth 2

“You can only subscribe to one provider”

This is a choice depending on whether or not you want to invest in one or more ISA accounts. For example, if you decide to invest all £20,000 into a Cash ISA, you’ll have no choice but to invest in a single provider.

However, if you decide to split your allowance into 3 different ISAs, you can choose to invest in one or three providers depending on what type of ISAs they provide.

Myth 3

“You can only have one type of ISA”

You can have up to 4 types of ISAs every tax year. If you want to invest in four types, you will have to split the maximum allowance set for that tax year, currently, it’s £20,000 for 2023/24. You will also have to bear in mind you can only put a maximum of £4000 into a Lifetime ISA.

If you decide to reinvest in an existing ISA, you may do so. But this means you wouldn’t be able to invest in that same ISA type with a new provider in the same year.

Investing in a Lendwise Innovative Finance ISA

Support postgraduate education on the Lendwise platform. Help make a difference to students looking to study at top business schools such as London Business School, Judge Business School, Chicago Booth and many more. Help make a bright difference to ambitious postgraduate students. *Explore investment options today.

*Capital at risk. Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.

Check our Lender terms and conditions.

Lendwise Ltd is authorised and regulated by the Financial Conduct Authority under firm registration number 782496. Lendwise Ltd is not covered by the Financial Services Compensation Scheme. Registered in England (Co. No. 10455048). Registered with the Office of the Information Commissioner (No. ZA281795).

Myth 4

“You cannot withdraw money from an ISA account”

You can withdraw money from an ISA at any time without losing any tax benefits. However, you may have to check the terms of your ISA to see if there are any penalties for withdrawing early.

If you invest money and withdraw it in the same year, it does not mean that money is added back into your annual allowance. Once it’s used up, it’s used up.

Myth 5

“I have to invest/save a lot of money”

There is a limit of £20,000 in the 2023/24 tax year but it doesn’t mean you have to invest it all. You should only invest what you can afford and not strain your financial security. There are also many low minimum ISA subscriptions – some as low as £1.

This blog is not intended to give out any financial advice. If you are interested in investing in an ISA or a non-savings account, you should seek advice from an independent financial advisor.

Your capital could be at risk.

ISA Myths 6-10

Myth 6

“I have to invest £20,000”

The maximum allowance for the 2022/23 tax year is £20,000. You can invest up to the maximum limit and you can split it up among your ISAs (only one per year). You should only invest what you can afford and not put your financial security at risk.

Myth 7

“Nobody invests/saves using ISA anymore”

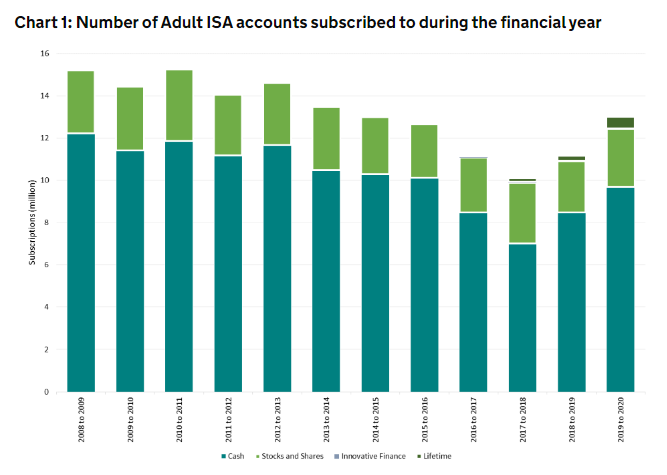

ISAs investments are growing every year. In 2019/20, there were 13 million new subscriptions. With new subscribers, more money is being invested and the market cap increases. In addition, there are [probably] people who are reinvesting in an account they already own which would not be counted as a new subscription.

You can only invest in to one type of ISA per tax year.

Myth 8

“The tax exemption is not that high or important”

Any interest your money gains through an ISA investment is tax-free. This means you can continue to invest your interest-free money on top of your original investment to gain even more money. This is called compound interest.

This blog is not intended to give out any financial advice. If you are interested in investing in an ISA or a non-savings account, you should seek advice from an independent financial advisor.

Your capital could be at risk.

Myth 9

“There is a cap on how long I can keep an ISA and how much I can earn tax-free”

There is no set limit to how long you can keep your money in an ISA. This solely depends on the provider. There are annual subscriptions that could give you better returns the longer your money remains with the provider. But any money your investments make is 100% tax-free.

But you should look at the terms of the agreement with the provider. There may be penalty charges for withdrawing your money early (especially if it’s part of a multi-year subscription).

Myth 10

“Not a lot of money is invested/saved using an ISA”

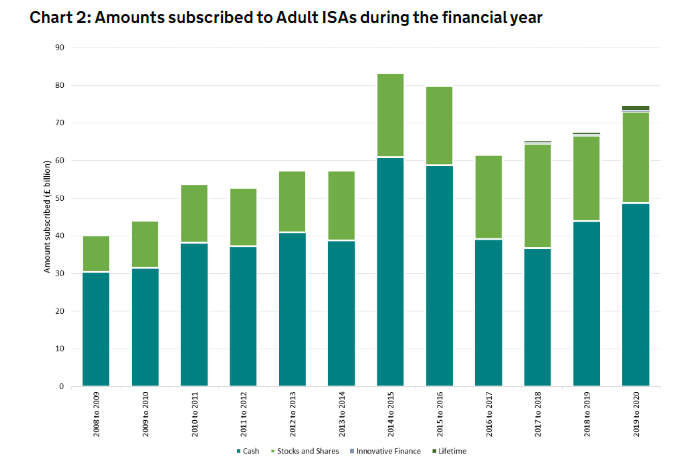

It is a choice whether or not you want to invest the full allowance limit. With more and more subscriptions, the valuation of the ISA market is increasing. Because of this, more money are being invested. Chart 2 below shows investment in 2019-20 reached £75 billion, an increase of £7.1 billion in the previous year. While the years between 2014-16 reached £80 billion and more, there has been a steady increase since.

To note: While the pandemic may have lowered subscriptions yet again, trends show that it will steadily rise again.

ISA Myths 11-14

Myth 11

“Not a lot of money is invested and earned using an ISA”

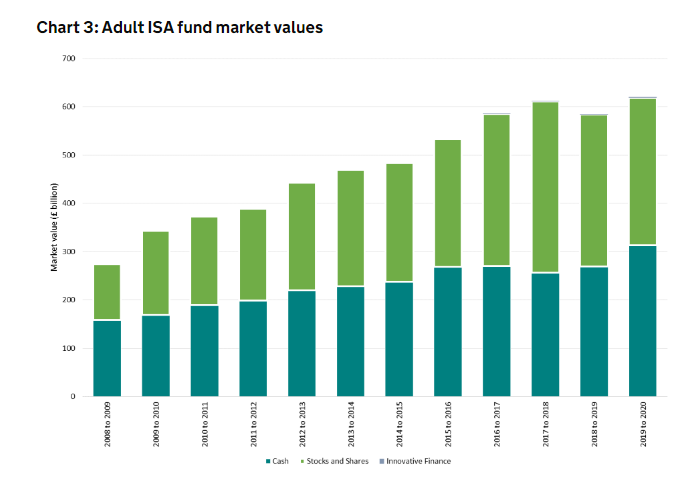

With more and more subscriptions being created every year, ISAs are becoming more and more valuable. At the end of the 2019/20 tax year, the market value of all Adult holdings rose to a staggering £620 billion. This is the biggest valuation in ISA history to date.

Chart 3 shows which type of ISA makes up the total market valuation. Cash holds the majority on most bars, while Stocks & Shares hold the rest, As you can see, IFISA holds a tiny amount compared to the others. This is because it was only introduced at the start of the 2016/17 tax year and it is not covered by the FSCS protection scheme.

Myth 12

“Low-income bracket earns do not use ISA accounts”

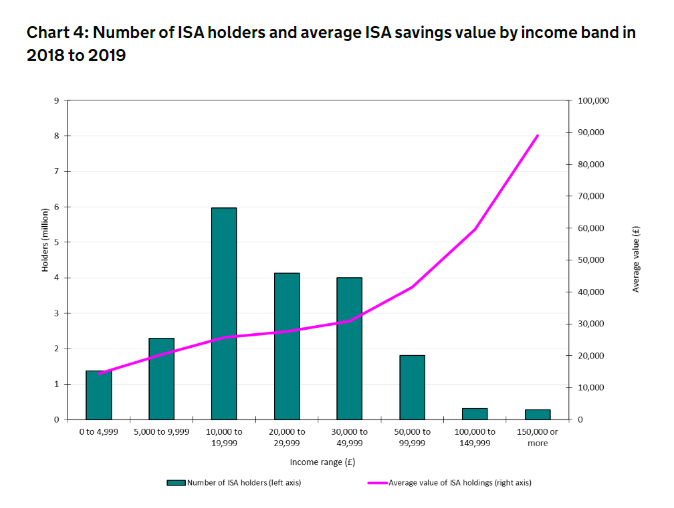

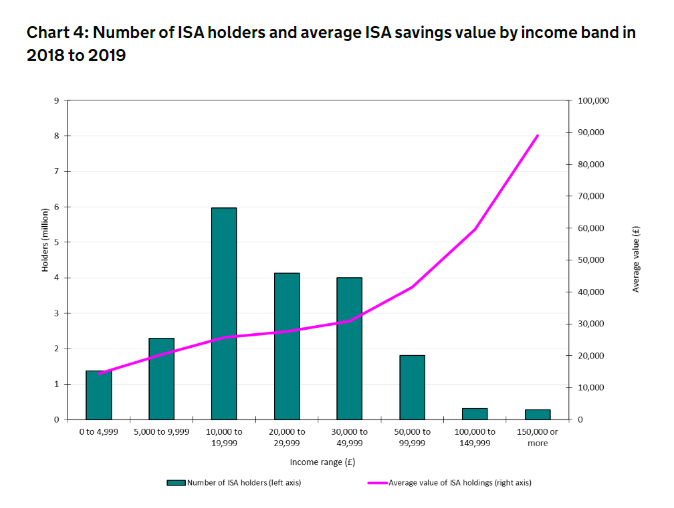

This statement is completely wrong. In fact, a majority of the Adult ISA holders reported their income to be less than £20,000. As you can see from the chart below, roughly 10 million of the 20 million Adult subscribers’ income per year is less than £20,000. While this is half of the analysed holders, you can see the breakdown of the bands leans more towards lower income bracket earners.

This blog is not intended to give out any financial advice. If you are interested in investing in an ISA or a non-savings account, you should seek advice from an independent financial advisor.

Your capital could be at risk.

Myth 13

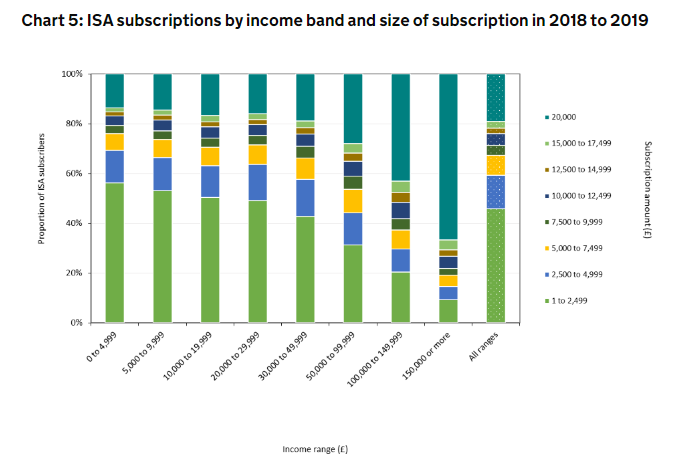

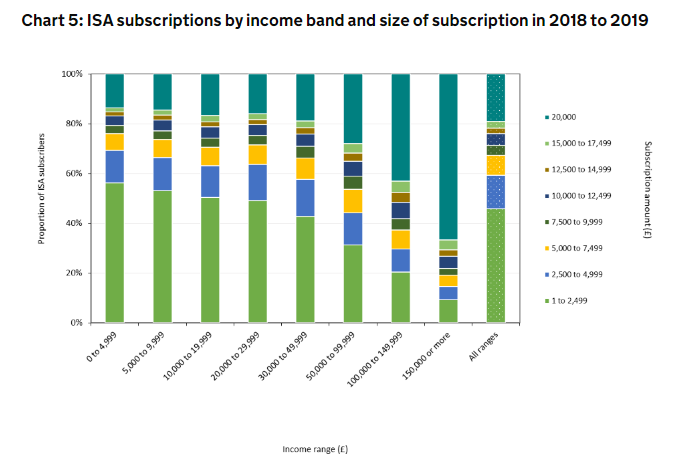

“Very few people invest/save the maximum allowance limit of £20,000 per year”

Investing £20,000 per tax year is something most people are unable to do. This is usually the case with wealthier individuals who have the spare income to do so. Chart 5 below is based on a survey analyzed by 20 million subscribers. It shows roughly how much each band on average invested in the 2018-19 tax year. As you can see, the lower the income, the less one is to invest the maximum allowance, while the more one earns, the higher the chance of the maximum allowance to be met.

By using the last bar, roughly 3.6 million (18%) subscriptions in 2018/19 used the maximum allowance of £20,000.

Myth 14

“Nobody I know holds an Individual Savings Account”

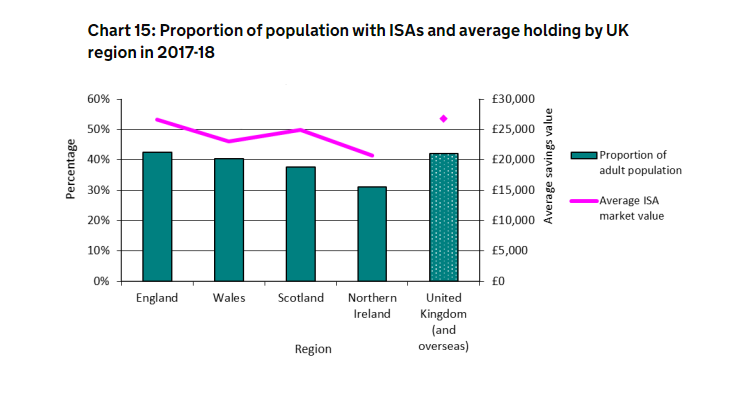

This statement is both true and false. It is possible not to know anyone who holds an account, but it also depends if the person is willing to disclose that information.

The graph below shows that in the 2017/18 tax year, 42% of adults in England held an account – this amounts to roughly 20 million people.

ISA Myths 15-17

Myth 15

“I have to subscribe the whole amount in one go”

You can invest in an ISA at any given time within a tax year. The tax year runs from 5th April to 4th April. You can invest half before Christmas and half after, or you can invest what you can afford. You must not invest above the maximum limit.

There is a possibility that you may accidentally invest over the maximum limit – you should keep a note of how much you invest. If you have, it’s advised not to correct the mistake by drawing the money out. You should call the HMRC ISA helpline on 0300 200 3312. As a first-time offence, you will most likely be given a warning. If this is a repeated issue, fines may be issued.

Myth 16

“It only works for wealthy people”

Chart 4 below shows the details of 20 million Adult account holders analyzed by income band in 2018/19. The graph shows the median holders by income had an average income between £20,000-£29,999.

While it is true the average value of savings for wealthier individuals is higher, the graph also shows that lower-income people hold the bulk of the subscription accounts.

Myth 17

“It’s a big hassle transferring from one provider to another”

Transferring from one provider to another has never been easier. In the past, you needed to your provider via the bank or receive a form in the post but that is no longer the case. All you need to do is fill out a form online (or in paper form) at your new preferred provider and they will take care of the transfer process with your old providers.

However, you should check beforehand if the new provider accepts transfers. You can view this on their webpage or faqs. You can visit the UK Government Individual Savings Account Transfers for more information.

Support postgraduate education on the Lendwise platform. Help make a difference to students looking to study at top business schools such as London Business School, Judge Business School, Chicago Booth and many more. Help make a bright difference to ambitious postgraduate students. *Explore investment options today.

*Capital at risk. Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.

Check our Lender terms and conditions.

**The tax treatment of interest and reliefs on defaults may be subject to change and tax treatment will depend on your individual circumstances.