Are ISAs worth investing in 2024?

In the realm of personal finance, one common path for savings and investments in the UK is the Individual Savings Account (ISA). As we step into 2024, many individuals are contemplating whether ISAs remain a viable option for their financial goals. In this blog post, we’ll explore what is an ISA and delve into the question: Are ISAs worth investing in 2024?

What is an ISA?

An Individual Savings Account (ISA) is a tax-efficient savings and investment account available to residents in the United Kingdom. The primary benefit of an ISA is its tax advantages, as any savings or investments held within an ISA are not subject to tax. Each year, individuals are given an ISA allowance, which sets the maximum amount one can invest without incurring tax liabilities**.

There are five main types of ISAs:

- Lifetime ISA

- Cash ISA

- Stocks and Shares ISA

- Innovative Finance ISA

- Junior ISA

The Lifetime ISA is designed to help individuals save for their first home or retirement, with the added incentive of a government bonus on contributions. Cash ISAs are savings accounts where interest earned is tax-free. Stocks and Shares ISAs allow individuals to invest in a variety of assets, such as stocks, bonds, and mutual funds, without paying tax on capital gains or dividends. Innovative Finance ISAs enable investment in peer-to-peer lending and crowdfunding opportunities. Junior ISAs are specifically for children under the age of 18, allowing tax-free savings and investments to be held on their behalf.

In the UK, individuals are subject to paying tax and National Insurance on most income and gains. However, certain allowances and exemptions 1 exist, including those for self-employment, dividends, personal savings, and personal allowances. Lottery winnings and premium bonds are also typically tax-free.

When does the ISA year start? And when does the ISA year end?

The ISA season aligns with the UK tax year, meaning your allowance for the new tax year begins on April 6th and concludes on April 5th of the following year.

When is the ISA deadline?

The deadline for investing or opening an ISA within the tax year technically falls on April 5th at 11:59 pm. However, it’s advisable to complete any final preparations a few days earlier, particularly if April 5th falls on a weekend, bank holiday, or Monday morning. This precaution allows ample time for administrative tasks to process your application or transfer funds fully.

Subsequently, the new ISA allowance commences at midnight on April 6th and remains in effect until 11:59 pm on April 5th the following year.

How much can I save in an ISA?

The maximum amount you can save in an Individual Savings Account (ISA) for the current 2024/25 tax year is £20,000. This allowance can be allocated across various types of ISAs according to your preference, or you can invest the entire amount in a single type of ISA. However, it’s essential to note that you cannot exceed the overall allowance limit.

To make the most of the ISA allowance, contributions must be made between April 6th and April 5th of the following tax year2. Any investments made outside of this period will count towards the next tax year’s allowance. It’s crucial to note that any unused allowance from the current tax year cannot be carried over to subsequent years and will be forfeited if not utilized.

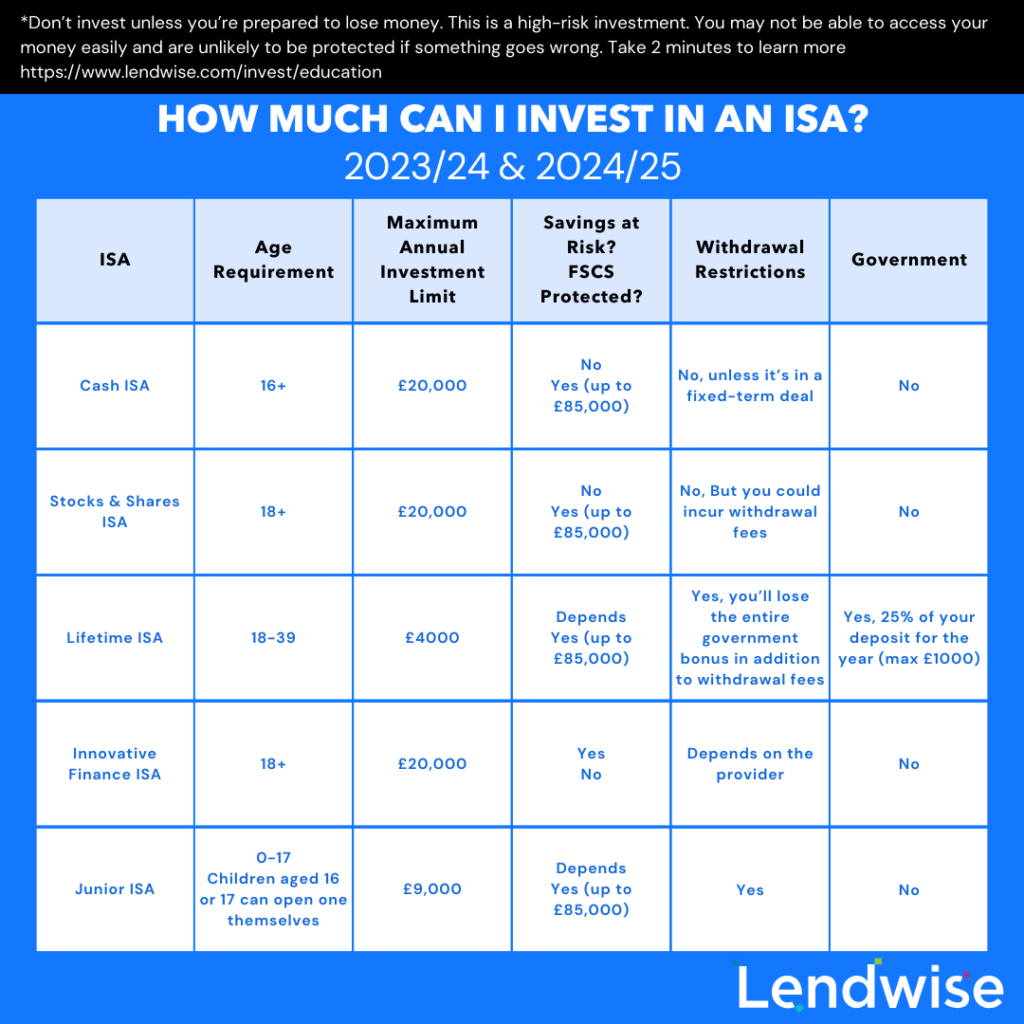

Below is a table providing additional details about an Individual Savings Account (ISA), including eligibility criteria based on age and any associated risks or penalties. It’s crucial to conduct thorough research and due diligence when considering investment opportunities, as not all providers offer the same level of quality or reliability.

Is an ISA a good investment?

If you’re pondering whether an ISA is a suitable investment, the answer is generally affirmative. However, it’s important to recognize that not all investment options are universally suitable for everyone. For instance, leaving your funds idle in a standard savings account or a Cash ISA may result in diminished returns when taking interest rates and inflationary pressures into account.

Cash ISA

A Cash ISA is a savings account where the interest is tax-free. It’s suitable for individuals who prefer to save money without taking on investment risks. Cash ISAs are the most common type of ISA, typically offered by banks and building societies.

Stocks & Shares ISA

A Stocks and Shares ISA allows individuals to invest in a wide range of assets including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Returns from investments held within a Stocks & Shares ISA, such as dividends and capital gains, are tax-free. This ISA is suited for investors willing to accept a higher level of risk in pursuit of potentially higher returns.

Lifetime ISA

The Lifetime ISA is designed to help individuals save for either their first home or retirement.

Individuals aged 18 to 39 can open a Lifetime ISA and contribute up to £4,000 per tax year. The government provides a 25% bonus on contributions, up to a maximum of £1,000 per year. Withdrawals are tax-free if used for a qualifying first home purchase or made after the age of 60.

Innovative Finance ISA

The Innovative Finance ISA allows individuals to invest in peer-to-peer lending platforms and crowdfunding opportunities. Returns earned from peer-to-peer lending or crowdfunding investments within an IFISA are tax-free. Investors should be aware that peer-to-peer lending involves lending money to individuals or businesses, and there is a risk of borrower default.

Junior ISA

A Junior ISA is a tax-efficient savings account specifically for children under the age of 18. Parents or guardians can open a Junior ISA on behalf of a child and contribute up to £9,000 per tax year. Any returns generated within a Junior ISA, whether from interest, dividends, or capital gains, are tax-free. The funds in a Junior ISA belong to the child and cannot be accessed until they turn 18.

Overall, the ISA market remains robust. As per HMRC’s Commentary for Annual Savings Statistics: June 2023 3, nearly 12 million Adult ISAs were subscribed in 2021-22, with a total investment exceeding approximately £66.9 billion (refer to Points 1.1 and 1.2 from Section 1: Individual Savings Accounts (ISAs)). Despite a slight decrease in the number of investments and subscribers, the market value of ISA funds surged by 8% to £741.6 billion.

How safe is my money in an ISA?

In general, ISAs offer a level of protection through the Financial Services Compensation Scheme (FSCS). Under this scheme, your money is safeguarded up to £85,000 per person per financial institution. In the event of your ISA provider facing insolvency, this protection ensures that up to £85,000 (or £170,000 for joint accounts) of your funds remain secure.

It’s crucial to note, however, that Innovative Finance ISAs operate differently. Unlike traditional ISAs, Innovative Finance ISAs are not covered by the FSCS. As Unbiased 4 states, IFISAs involve peer-to-peer investments, which fall beyond the scope of FSCS protection. Despite this lack of coverage, Innovative Finance ISAs often offer higher potential returns compared to their counterparts.

If you’re uncertain about a provider’s regulatory status, there’s no need to worry. You can easily verify their authorization by consulting the Financial Conduct Authority’s (FCA) online registry 5, accessible on their official website.

Lendwise IFISA

Discover the Lendwise IFISA is a platform revolutionising education finance and impact investing. Lendwise facilitates peer-to-peer lending, connecting investors with driven individuals seeking financing for their postgraduate or professional qualification studies.

Our platform presents a sustainable strategy for impact investing, allowing lenders to back higher education while seeking competitive financial returns. Lendwise offers innovative, student-friendly loans, enabling investors to positively impact ambitious postgraduate individuals. Lendwise has seen five years of impressive returns, which you can view in our statistics history.

Join us in reshaping the future of education and investment. Explore exciting investment opportunities*.

*Capital at risk. Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.

Click here for the Terms & Conditions.

**The tax treatment of interest and reliefs on defaults may be subject to change and tax treatment will depend on your individual circumstances.

Lendwise does not provide financial advice. If you require clarification or further information regarding investments or your financial security, please consult an independent financial adviser.

- Income Tax: Introduction. Gov.uk. ↩︎

- What type of ISA should I get? Money Saving Expert. ↩︎

- Commentary for Annual Savings Statistics: June 2023. HMRC. ↩︎

- What is an innovative finance ISA and how does it work? Unbiased. ↩︎

- Financial Services Register. Financial Conduct Authority. ↩︎