How Much Would You Need To Sustain Your Retirement?

Many people underestimate how much they will need to live on in retirement. The common perception is you need half or two-thirds of your normal salary after tax to maintain your lifestyle post-retirement.

This is because you’ll most likely have paid your mortgage, and no longer face the cost of bringing up your children and commuting. But is this really the case?

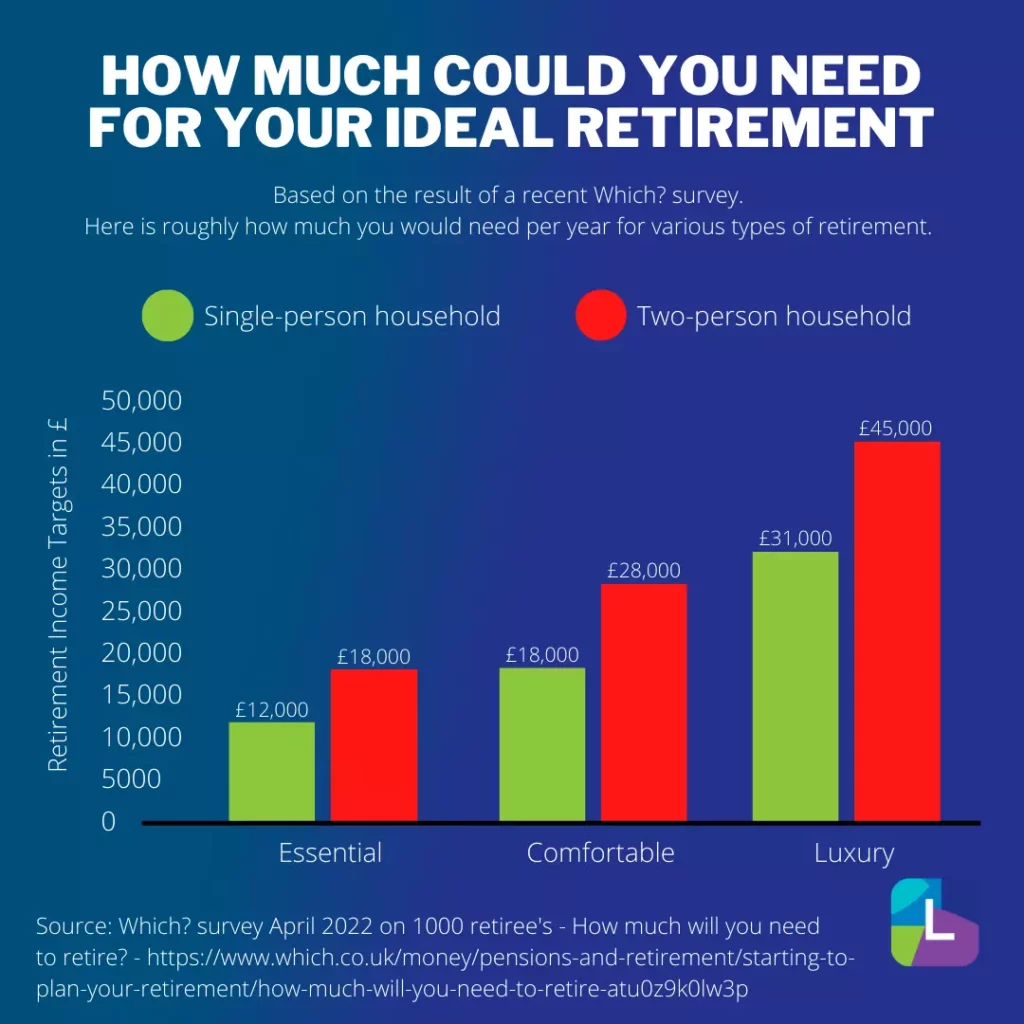

Which? spoke to thousands of retired people in their survey in early 2022, both those living alone and couples, to see where their money is being spent. They found households with two people spent roughly £28,000 a year on average to live comfortably.

Retirement expenditure

What is essential, comfortable, and luxury?

- Essential is the cost of essentials such as groceries, housing payments, insurance, transport, utilities, household goods, health, broadband, phones and clothes.

- Comfortable is a better quality of everything essential as well as holidays, recreational and leisure activities.

- Luxury is a better quality of essentials in addition to long-haul holidays, new gadgets, home improvements, and bigger and better leisure expenditure.

Which? has also reported people spent on average 5% less as a result of COVID-19 but with the rise of the cost of living, people have undoubtedly spent more on energy, food and petrol as the year progresses.

Travelling and holiday is an important part of retirement for most people. But prioritise change as you move through your retirement years. People tend to spend less on food and recreation while spending more on health, utility bills and insurance.

How much do you need in your pension pot?

Not everyone will earn the same amount as each others. Therefore it’s important to think about your pension income in stages – the state pension, your private and workplace pension, and any other income you may have.

Once you reach the state pension age, currently at age 66, the government will provide a substantial chunk of your post-retirement money. The current pension for 2022-23 is £185.15 per week but not everyone gets that much.

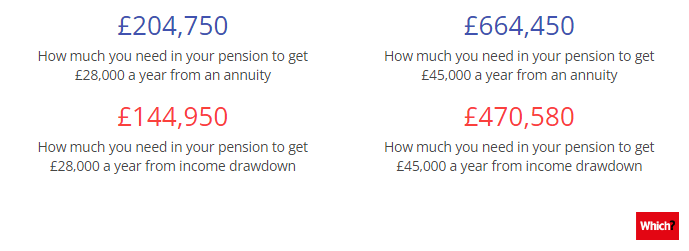

Most people with pensions opt for an income drawdown or an annuity, where money will be given to you as a regular income. Which? has crunched the numbers on how much you need in your pot to receive an annual amount post-tax.

How much do you need to save at different ages?

To live comfortably with your partner once you reach retirement age, you need to save almost £200 each every month. If you wait till 40 to start saving, this increases to £329 each. The projections are scary, especially with the rapid cost of living affecting the ability to comfortably save up. It can be reassuring with a couple hundred pounds per month in your 20s is easier to save up than having to scrabble a few more hundred by your 40s.

If you have £100,000 in your pot by your 30s, you are already on track to living a comfortable retirement and you can revise your targets.

Your monthly income should go up and if you’re in a company pension scheme, your employer will be contributing some toward that target. Under the rules of pension auto-enrolment, a minimum of 8% must be paid into your pension, 5% from you and 3% from your employer. Depending on your employer, most will match or put more into your pension that the legal minimum amount.

You will find the more you save or find an employer that matches your contributions, the closer you’ll get to these targets.

Pension tax relief

When you save into a pension, the government will give you a bonus in the form of tax relief. When you earn tax relief on your pension, some of the money you would have paid in tax would be sent into your pension pot. Tax relief is paid on your pension contributions at the highest rate of income tax you pay.

- Basic-rate taxpayers get 20% pension tax relief

- Higher-rate taxpayers can claim a 40% pension tax relief

- Additional-rate taxpayers can claim a 45% pension tax relief

The tax relief in Scotland will be slightly different.

Invest with Lendwise

Support postgraduate education on the Lendwise platform. Help make a difference to students looking to study at top business schools such as London Business School, Judge Business School, Chicago Booth and many more. Help make a bright difference to ambitious postgraduate students. *Explore investment options today.

*Capital at risk. Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.

Check our Lender terms and conditions.

Lendwise Ltd is authorised and regulated by the Financial Conduct Authority under firm registration number 782496. Lendwise Ltd is not covered by the Financial Services Compensation Scheme. Registered in England (Co. No. 10466048) with registered office at 3 More London Riverside, London, United Kingdom, SE1 2AQ. Registered with the Office of the Information Commissioner (No. ZA281795).

*As with all peer-to-peer loans, our products place capital at risk. You may not get back the full amount you lend and/or the interest you expect. Loans are made to individuals over a period of up to 10 years and as such, loans can be illiquid. The tax treatment of interest and reliefs on defaults may be subject to change and tax treatment will depend on your individual circumstances. Any reference made to past performance or forecasted performance of interest rates is not a reliable indicator of future performance. Lendwise Ltd, trading as Lendwise, does not provide investment or tax advice, and information on this website should not be construed as such. You should consider seeking independent tax and financial advice before making a peer-to-peer loan.